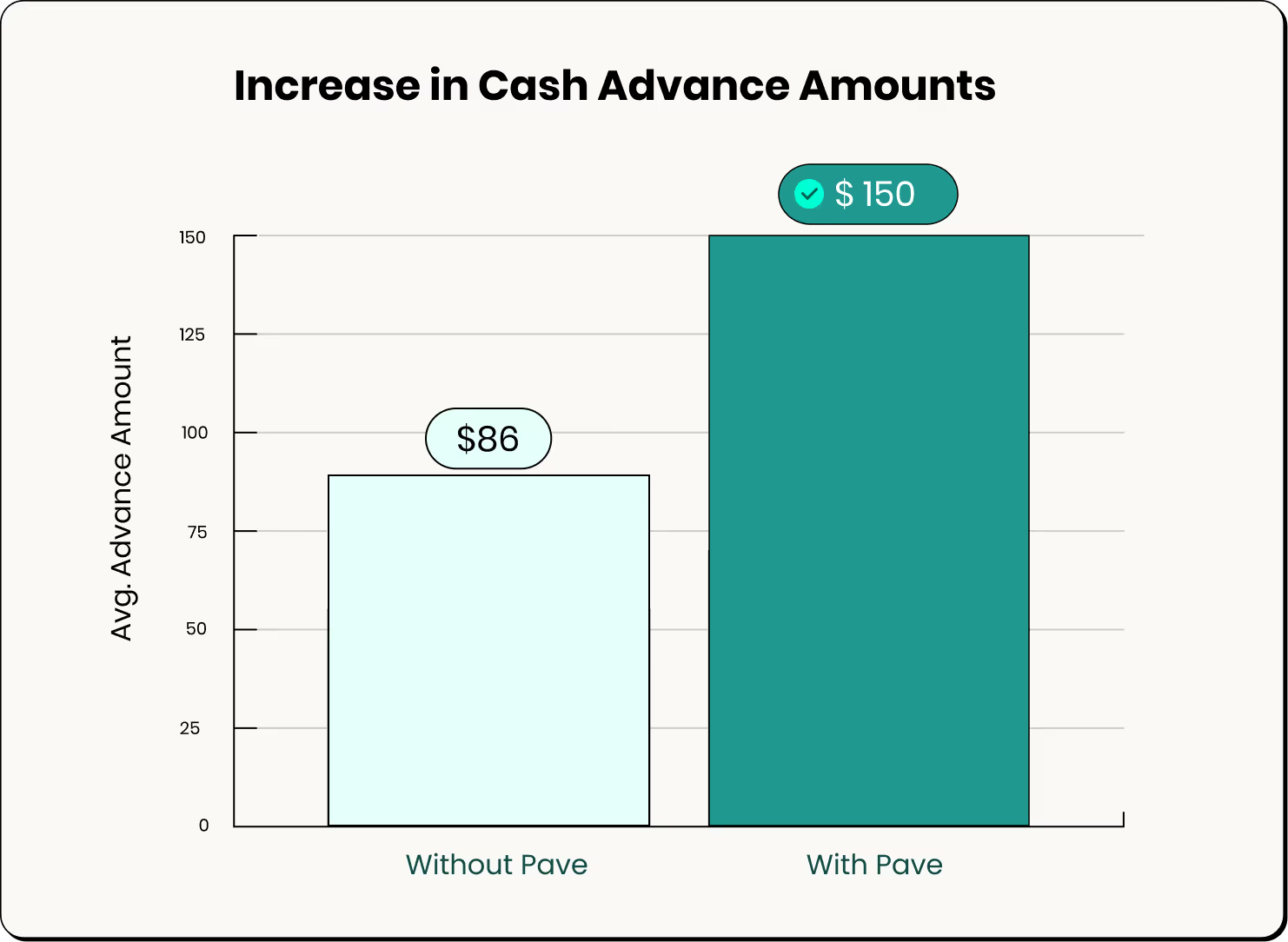

Cash Advance Provider Increased Amounts by 74%

Learn how a cash advance provider used Pave's Cash Advance Score to increase advance amounts by 74% while maintaining repayment success.

Goal

Top 10 cash advance providers wanted to increase cash advance amounts for users.

Problem

Provider had aggressive revenue targets, but lacked the visibility to identify new areas of opportunity, including users who could reliably repay the larger advances they aimed to provide.

Solution

By leveraging Pave’s Cash Advance Score, the provider was able to extend 74% higher advance amounts to high scoring users, ultimately increasing net revenue by 18%.

Challenge

Cash advance providers aiming to offer higher advances face multiple challenges:

- Limited Repayment Visibility: Providers don’t know which users have successfully repaid higher advance amounts or have outstanding balances with other providers

- Limited training data: Providers lack extensive repayment history, including for higher amounts, limiting their ability to train their risk models

- Feature Engineering Constraints: Developing robust predictive features from limited and unstructured data necessitates significant data science and engineering efforts, slowing down the model development process

These challenges limited the provider’s capability to increase advance amounts for low-risk users.

Approach

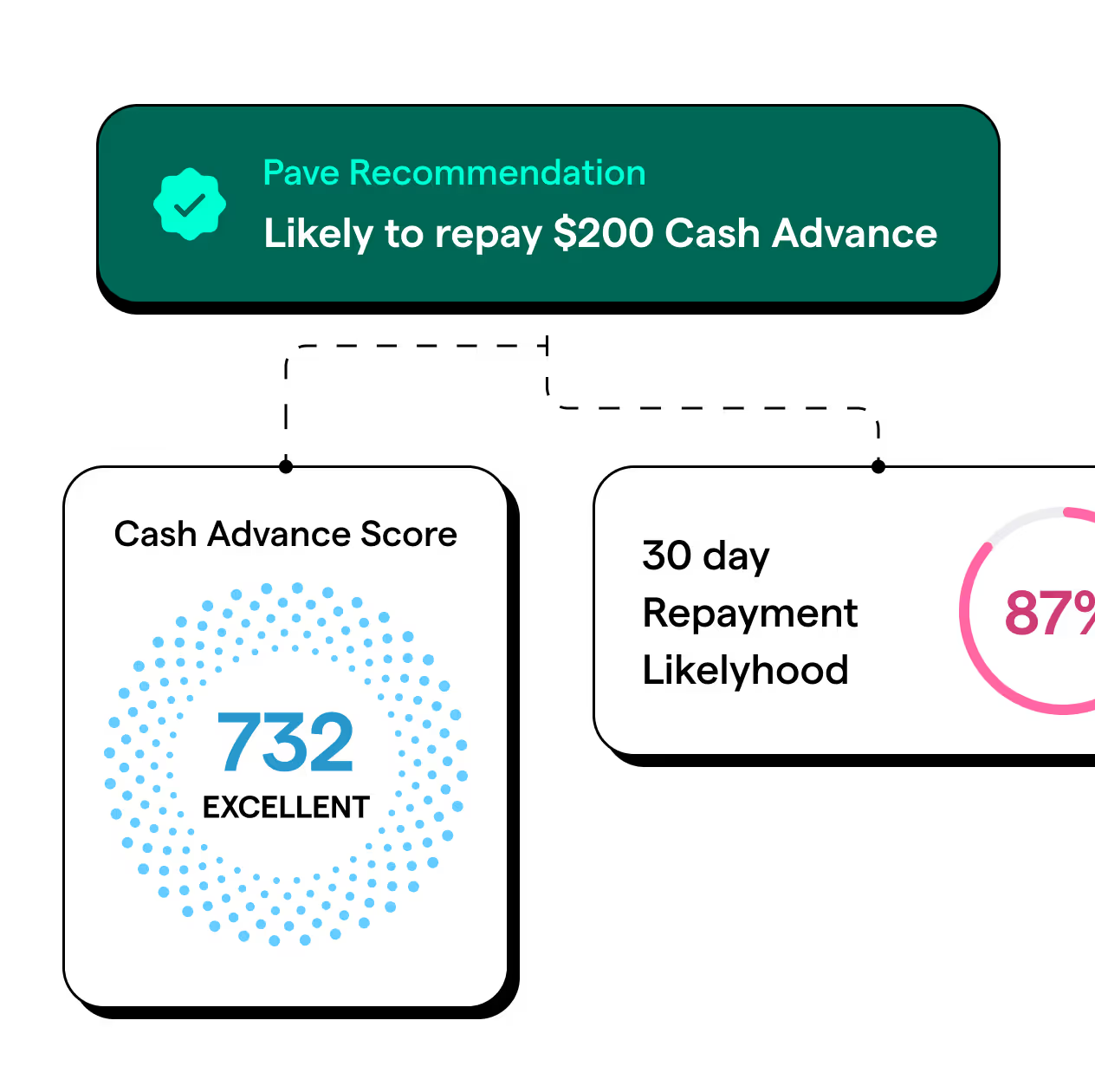

To address this, the provider adopted Pave’s Cash Advance Score, a cashflow-driven score designed to predict the likelihood and ability of a borrower to repay a cash advance. This score is trained on an expansive dataset across cash advance providers, including cash advance transactions, performance data, and delinquencies.

By leveraging Pave’s Cash Advance Score, the provider was able to responsibly offer higher advance amounts for low-risk users who’ve successfully repaid higher advances from other providers. Additionally, the provider was able to decrease the number of advances extended to low-scoring users.

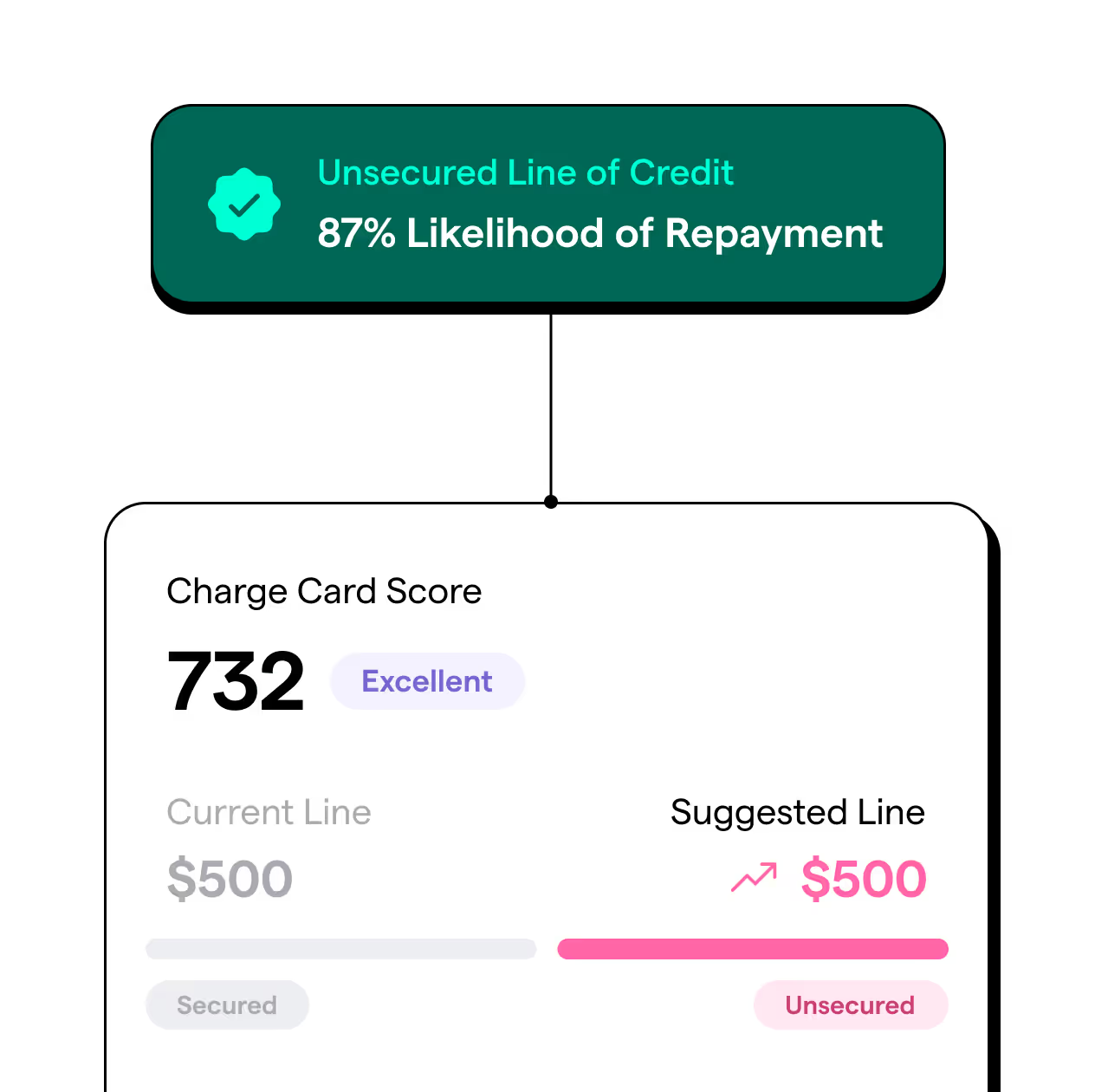

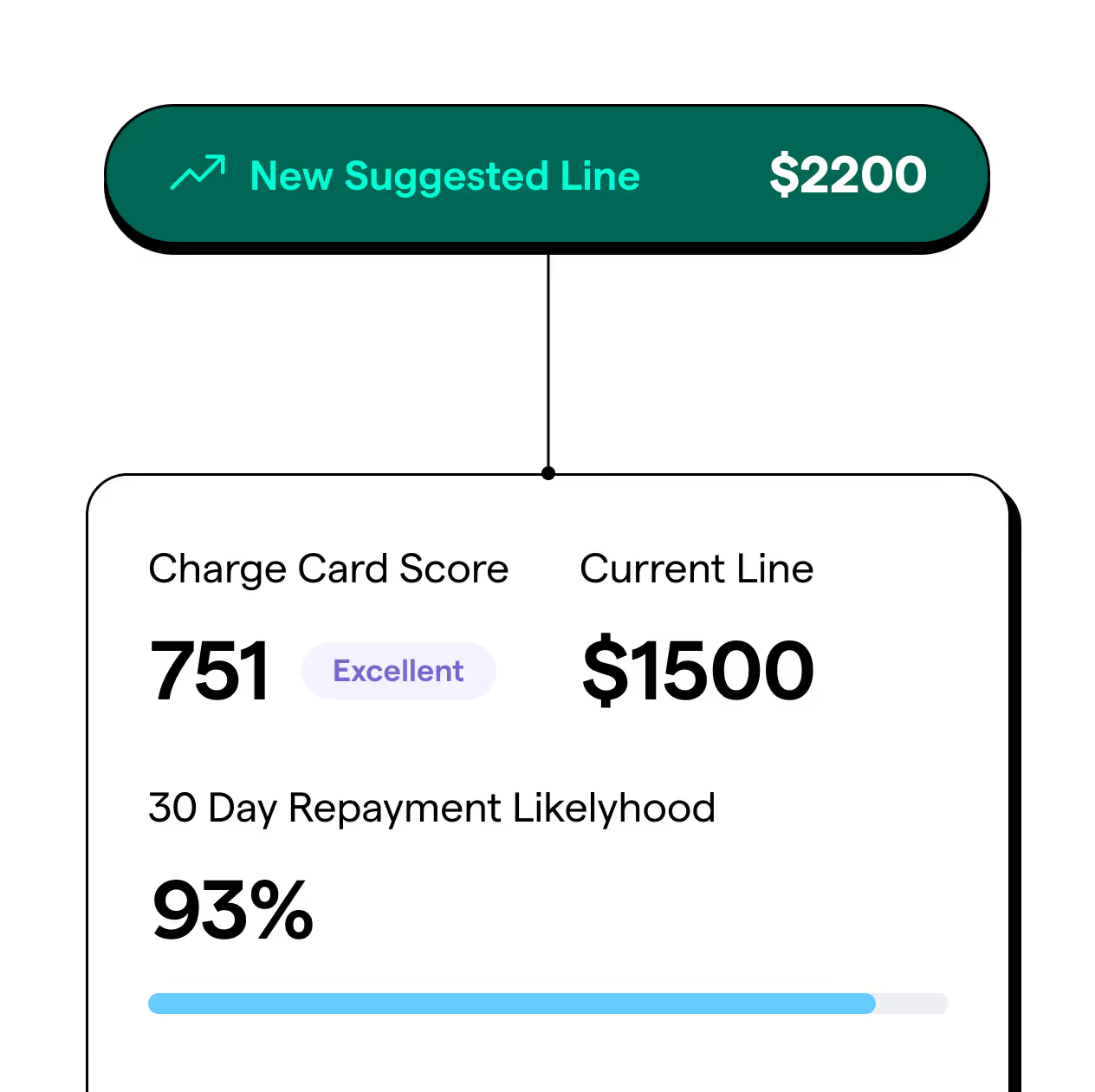

Here’s a quick demo of our Cash Advance Score:

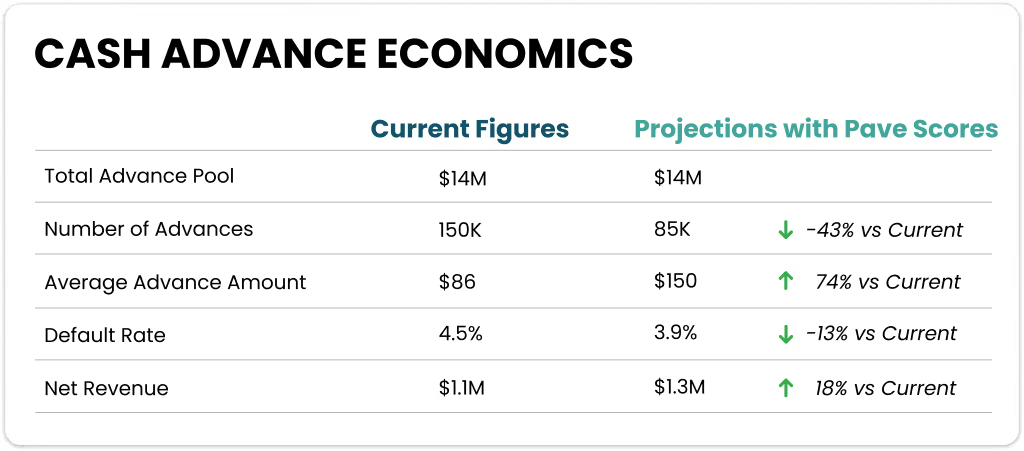

Result: Lender Increased Advance Amounts by 74%, Leading to 18% Increase in Net Revenue

The provider’s implementation of the Cash Advance Score resulted in an 18% increase in net revenue, enhancing operational efficiency and improving customer experience by providing 74% higher advance amounts for high-scoring users.

Keeping the advance pool constant ($14M in total advances), the cash advance provider was able to increase net revenue due to:

- Average advance amount increased by 74%, reflecting a strategy of offering higher advances to high-scoring (low-risk) users

- Number of advances decreased by 43%, as a result of granting fewer advances to low-scoring (high-risk) users

- Default rate decreased by 13%, indicating a stronger repayment performance

Conclusion

Cash advance providers struggle with accurately assessing who can safely be given larger advances. By leveraging Pave’s Cash Advance Score, the provider was able to benefit from Pave’s score trained on a wide variety of users and hundreds of attributes, including their repayment history across providers, allowing them to increase advance amounts to low-risk users while decreasing overall risk.

Teams can leverage Pave’s Cash Advance Score in their proprietary models to increase cash advance amounts and net revenue. Read more about our Cashflow Scores or book a demo.

Explore Use Cases

Cash Advance

Score users to increase approvals, advance amounts, and improve repayments.

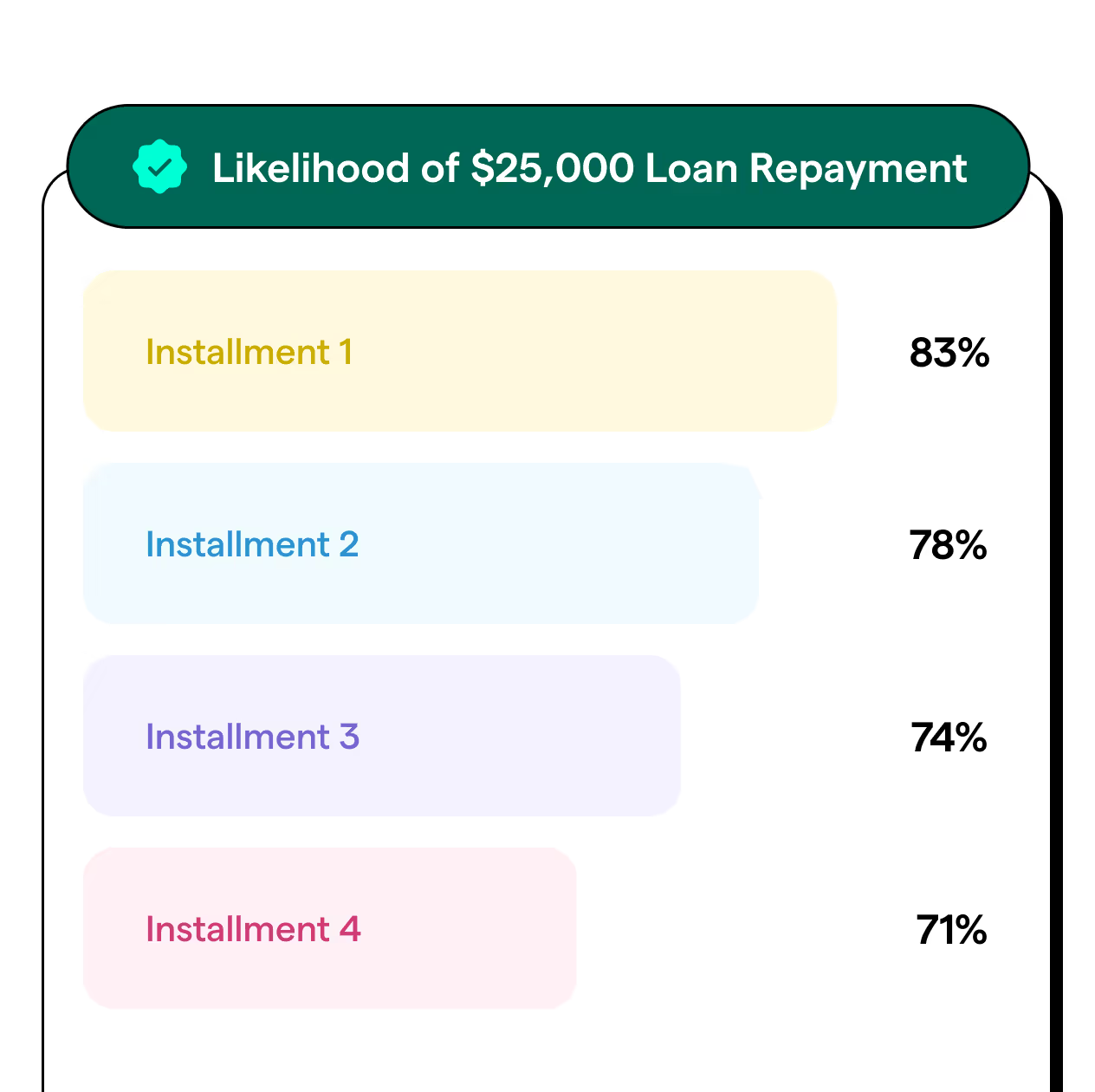

Personal Loans

Identify users with high likelihood of making the first 4 payments to reduce delinquencies.

Charge Cards

Graduate users to higher secured or unsecured limits based on increased affordability.

Credit Cards

Set dynamic credit limits based on users' income and affordability.

Drive growth with Cashflow-driven Analytics

Use our Cashflow-driven Attributes and Scores to provide timely, borrower-specific insights tailored to your lending criteria. Make informed decisions that enhance approval rates and loan performance.