Charge Cards

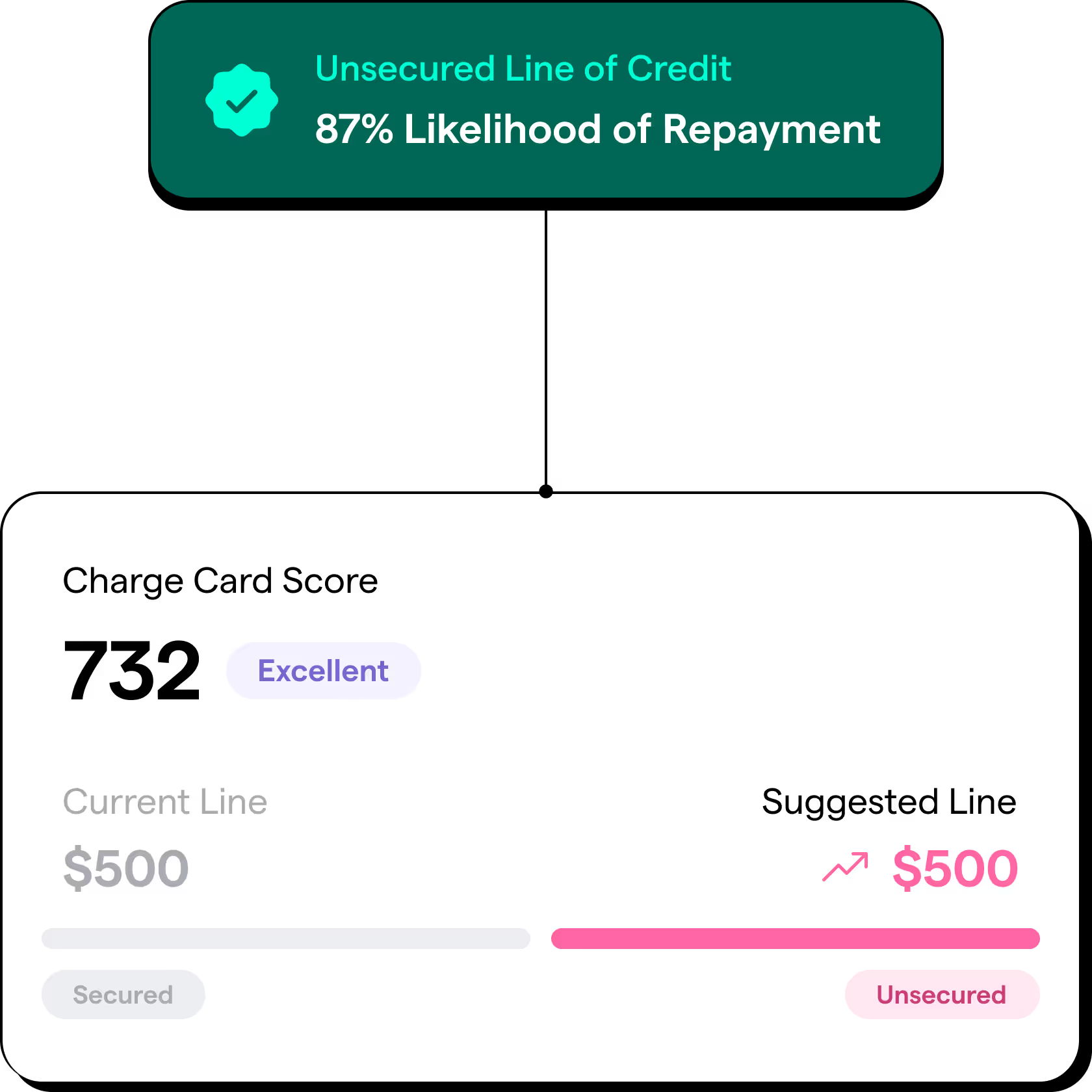

Minimize onboarding risks for secured charge cards with Cashflow-driven Attributes and Scores to transition eligible users to unsecured credit lines.

Increase growth with Cashflow-driven Analytics and Scores

Enhance account monitoring across credit tiers by leveraging real-time Cashflow Analytics to offer users credit limits based on amounts and terms they can afford to repay.

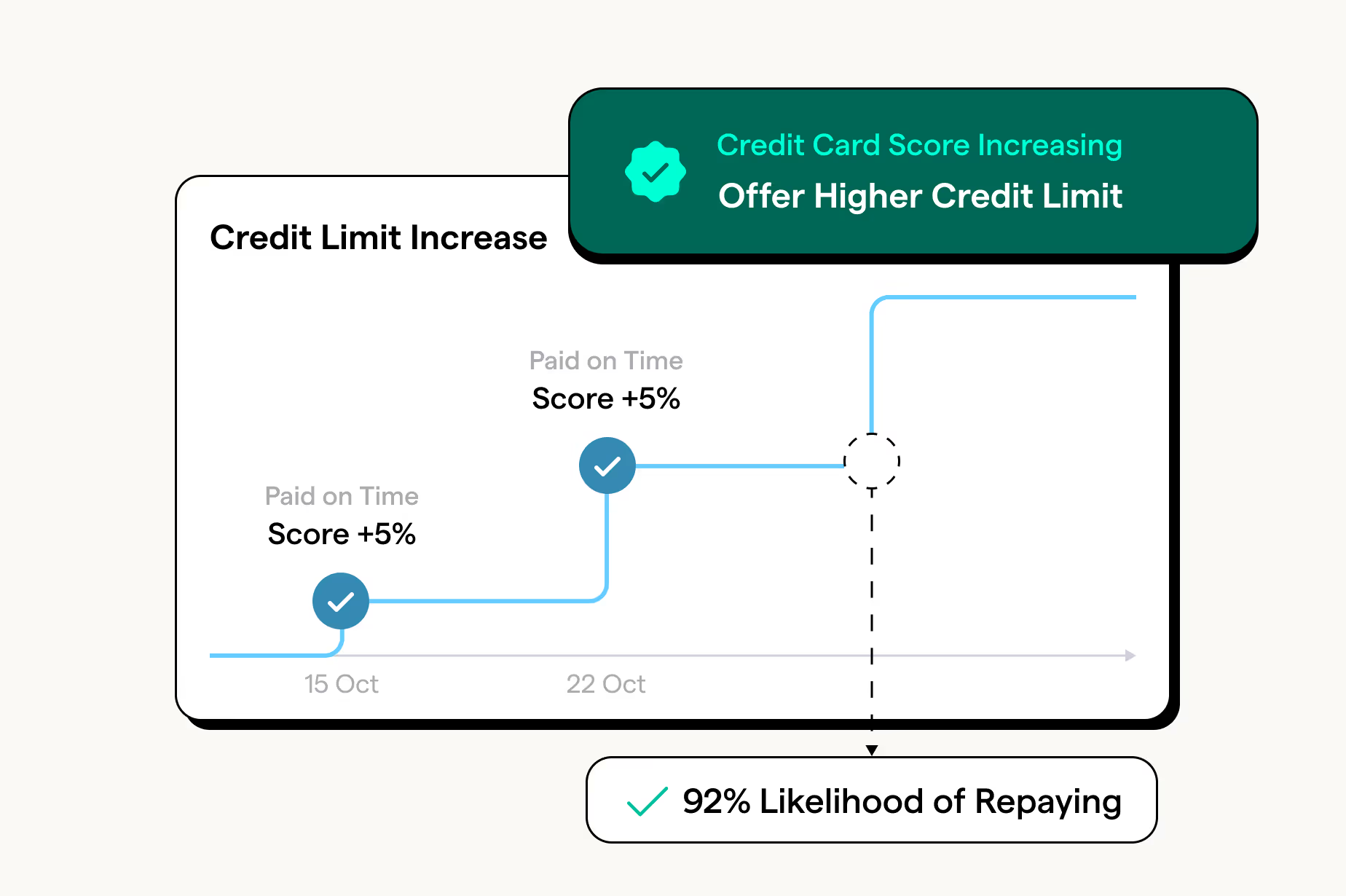

Safely increase unsecured card limits

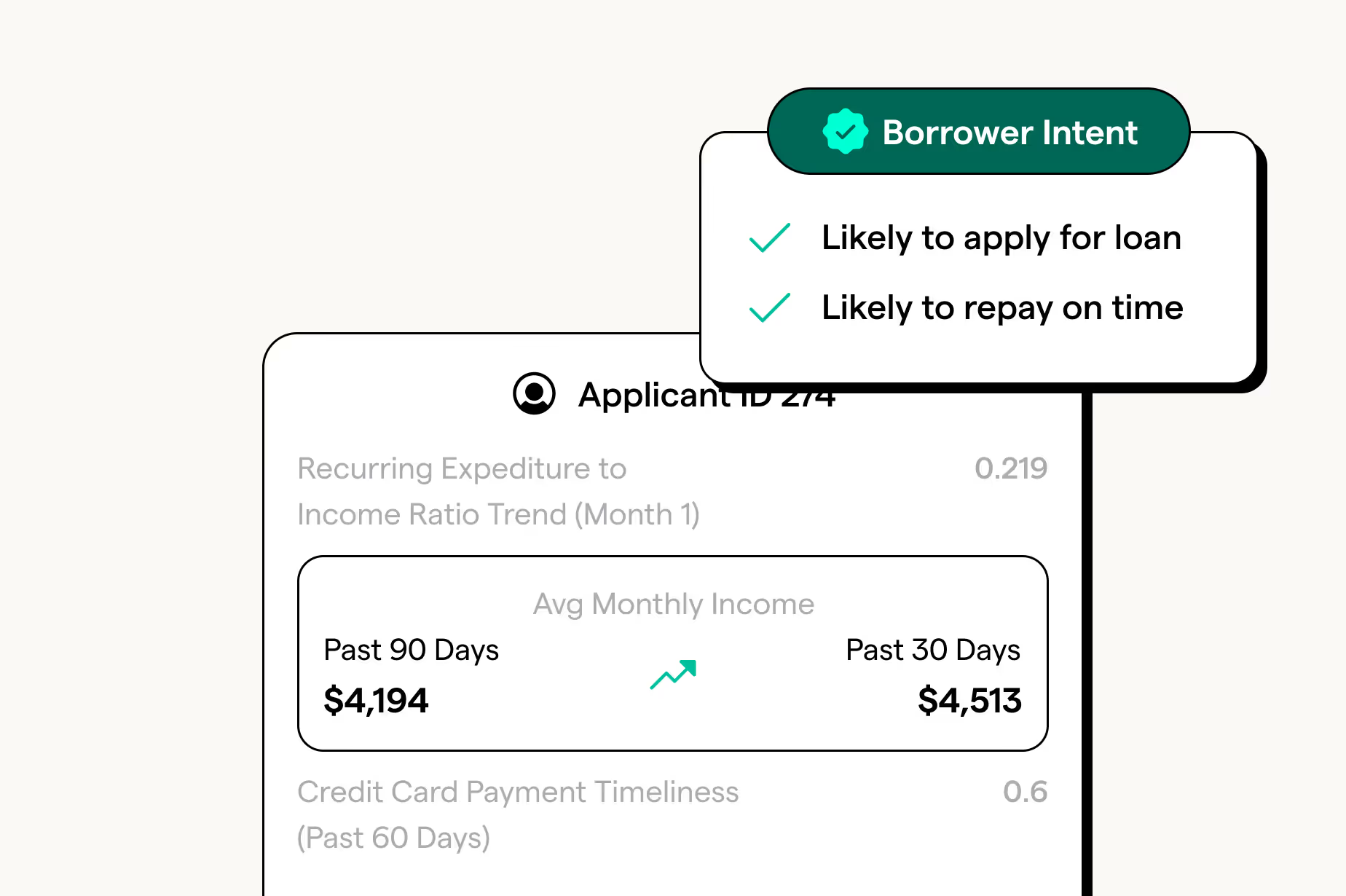

Identify users who have demonstrated they can repay higher amounts based on signs of healthy cashflow across income, balances, liabilities, and more.

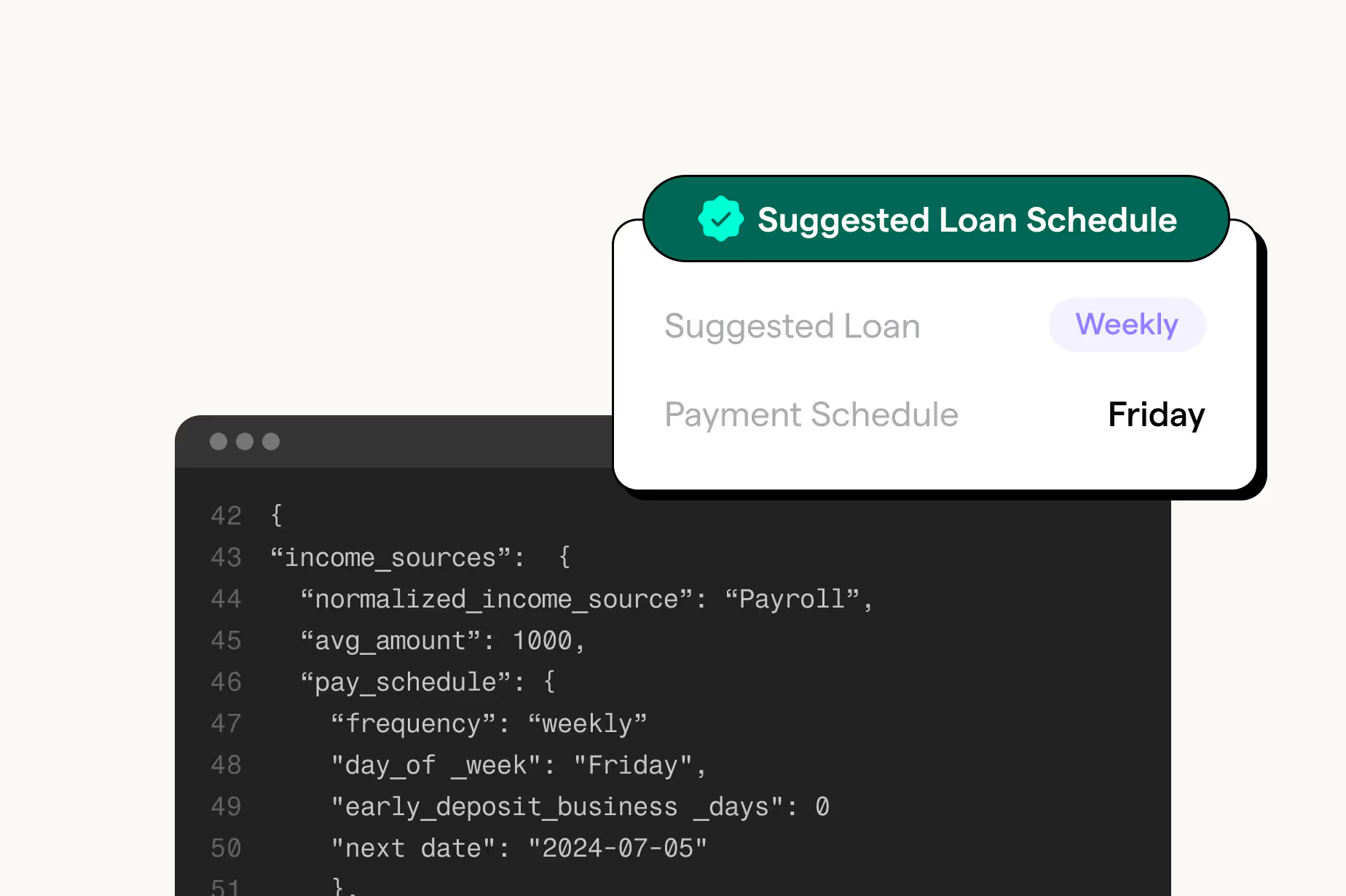

Align payment dates with user's income

Identify multiple income streams and align the scheduled payment date with when users have funds, reducing NSFs and building trust.

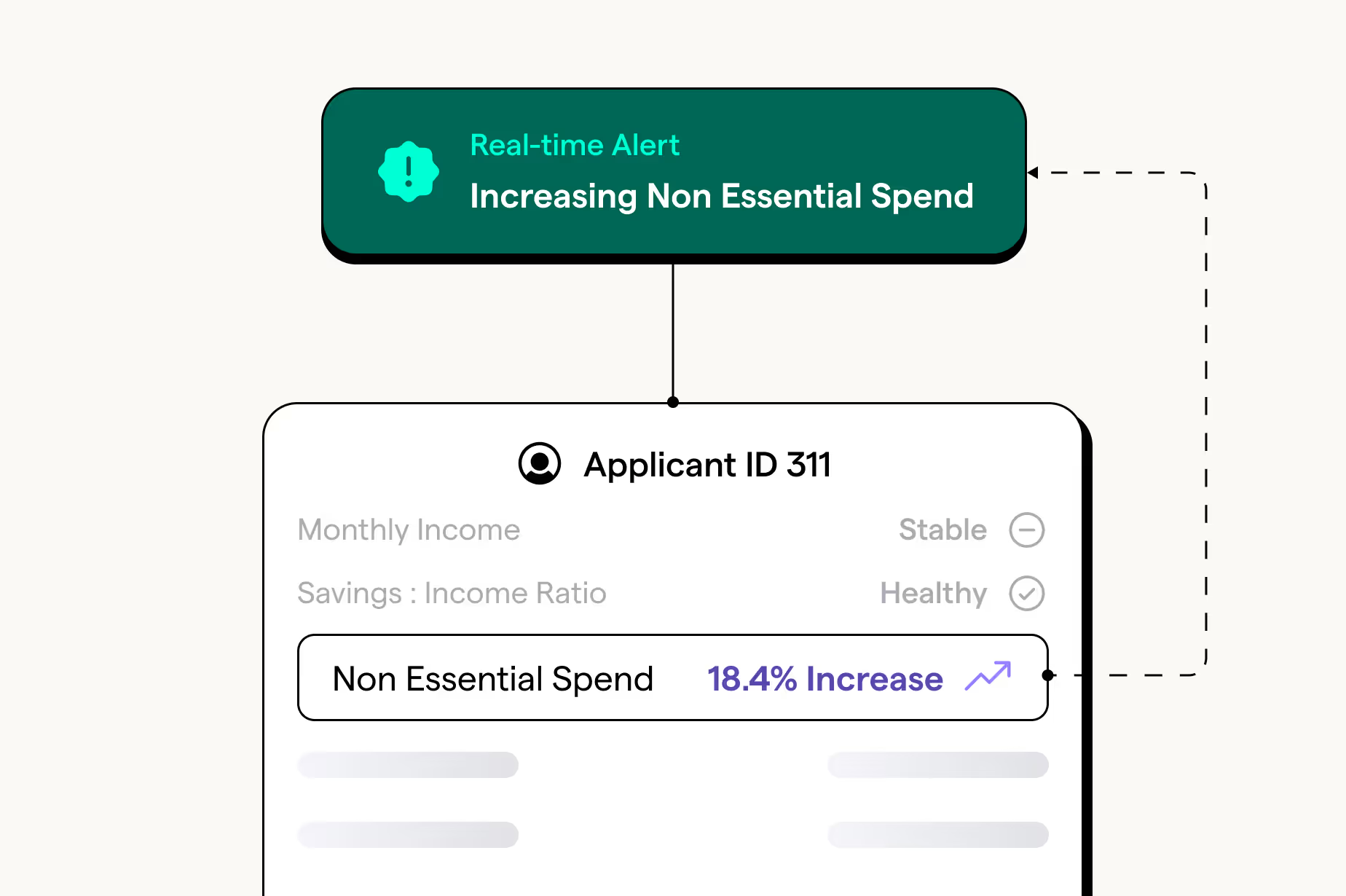

Track accounts in real-time

Track real-time income stability, spending, and financial health to adjust loan amounts, foster growth, and proactively mitigate risks before they impact your portfolio.

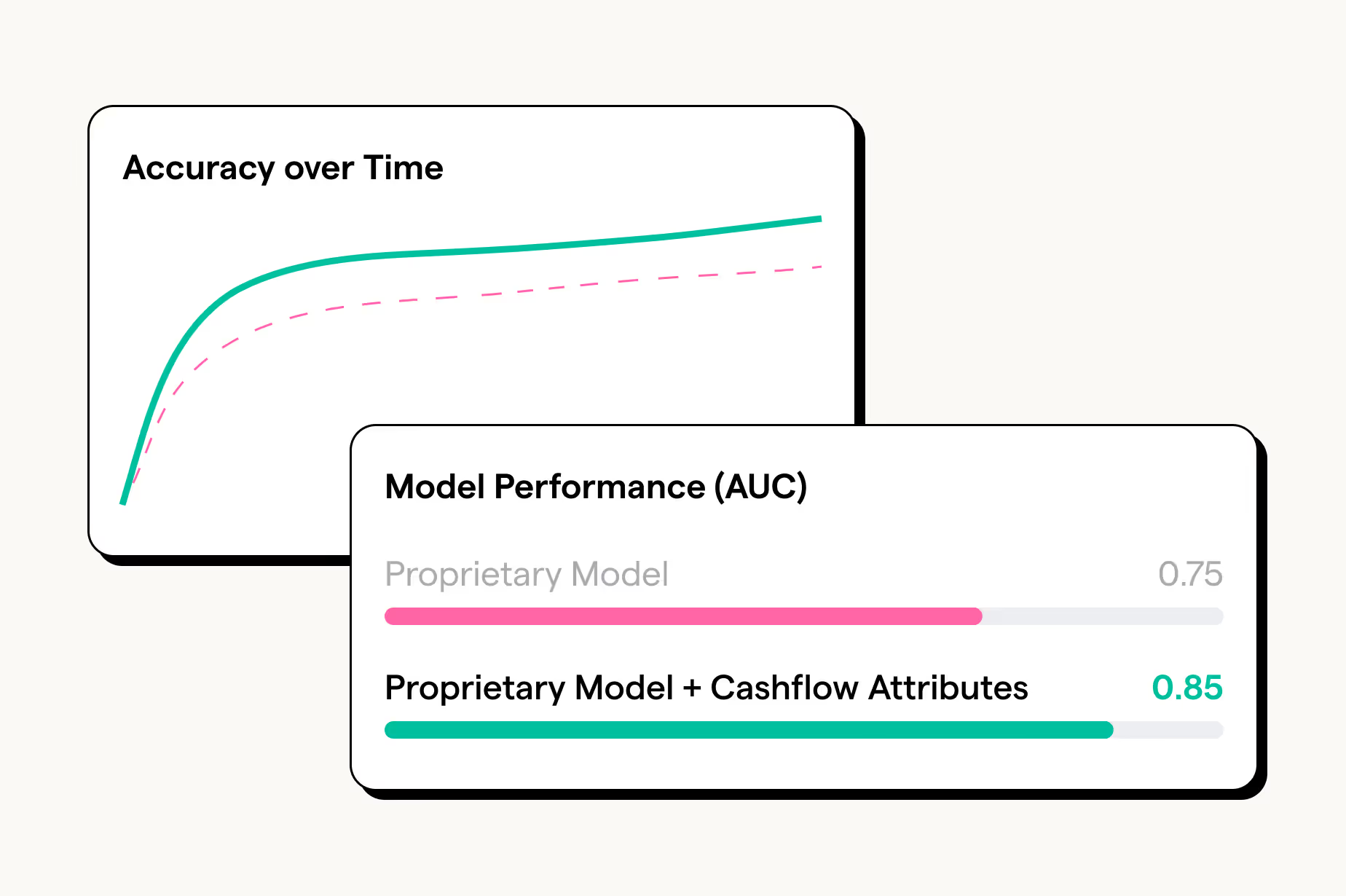

Improve accuracy in risk models

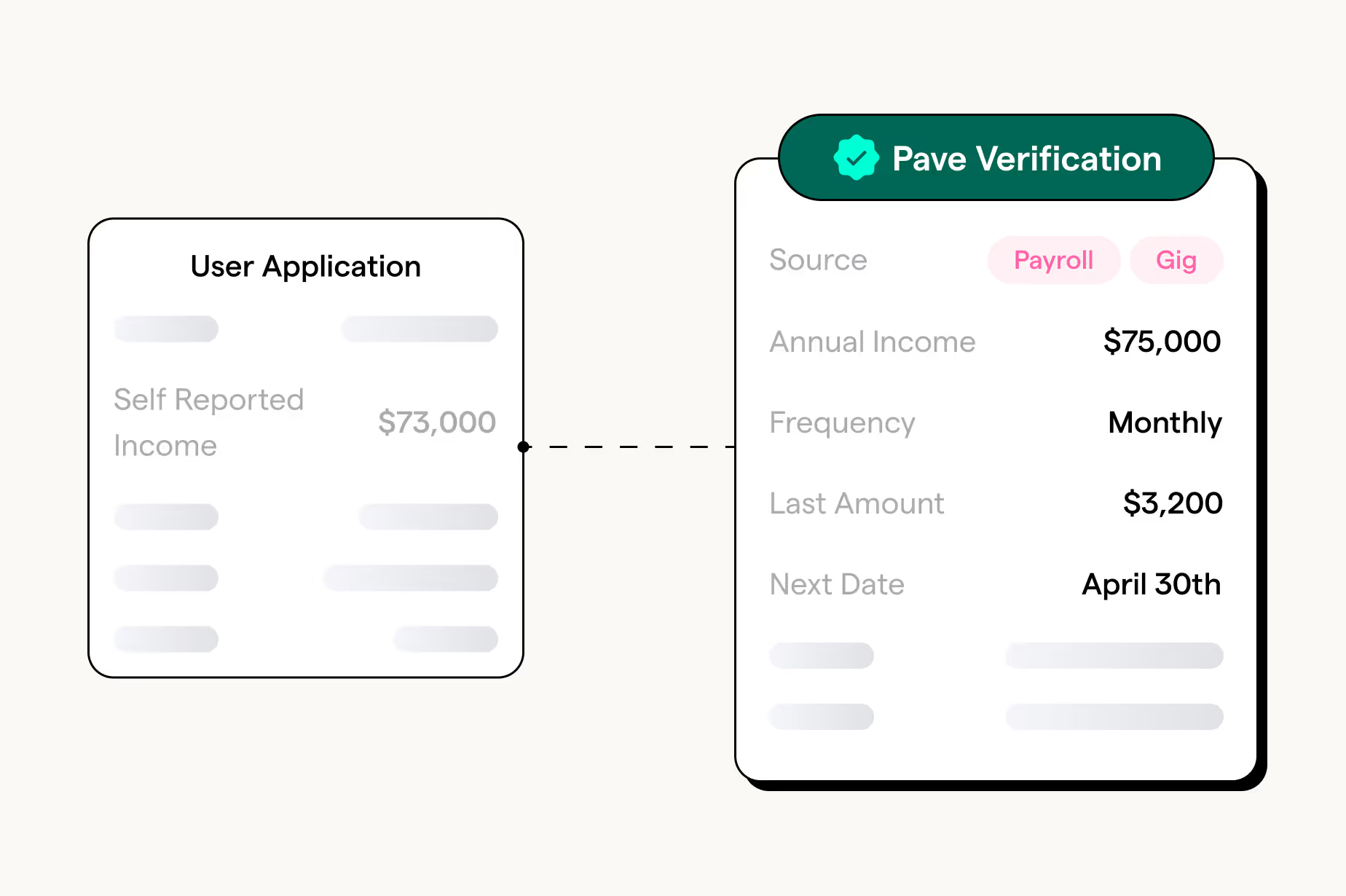

Use cashflow analytics to enhance proprietary risk models and get a more accurate view of borrower creditworthiness and affordability, making the transition to unsecured lines smoother and less risky.

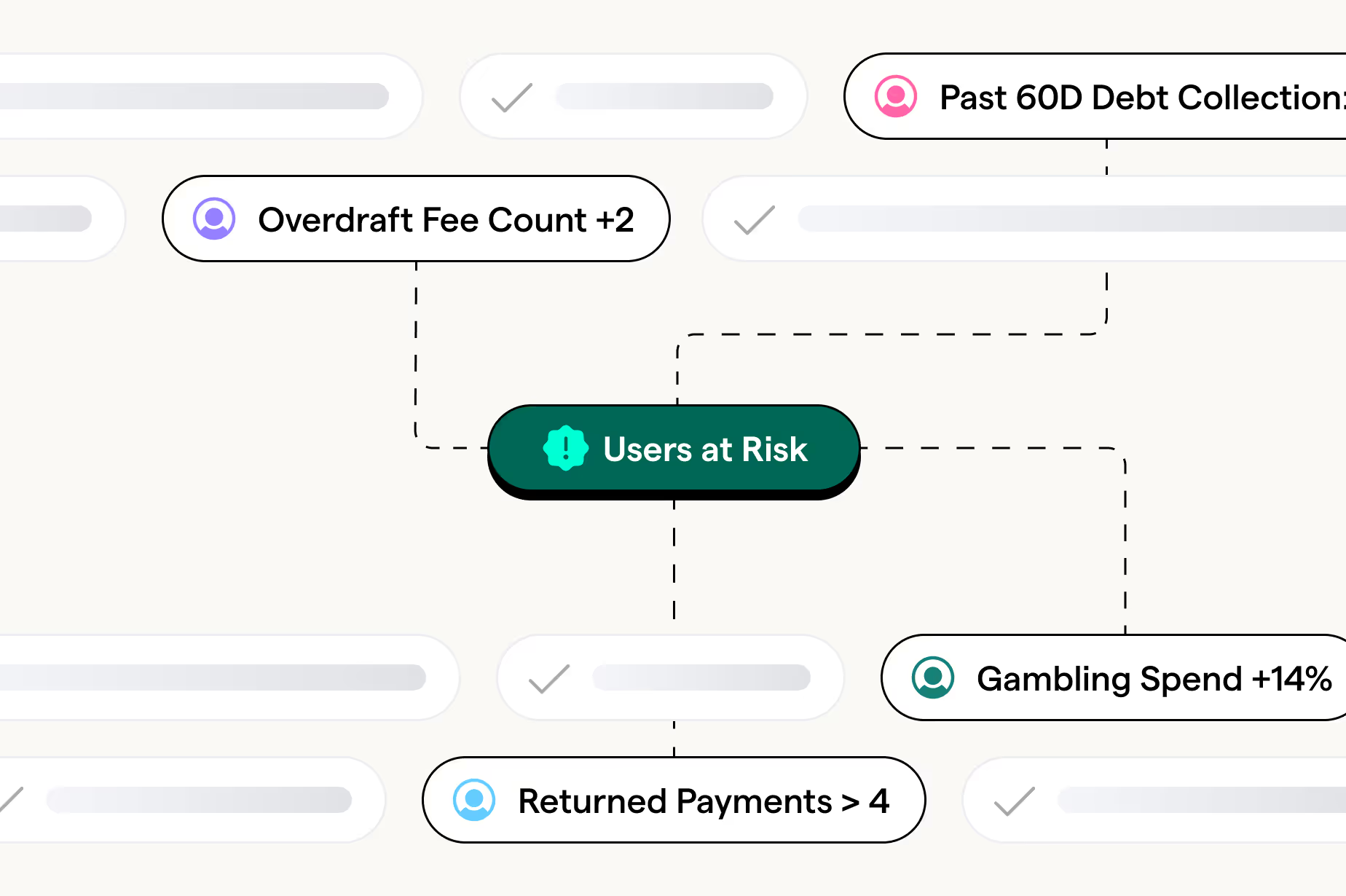

Identify pre-delinquency triggers

Surface risky behaviors from cashflow data like users falling behind on loan payments, loan stacking, and frequent chargebacks or returns.

Graduate users to unsecured credit

Strategically target existing customers demonstrating increased affordability for unsecured cards or secured line increases.

Explore More Products

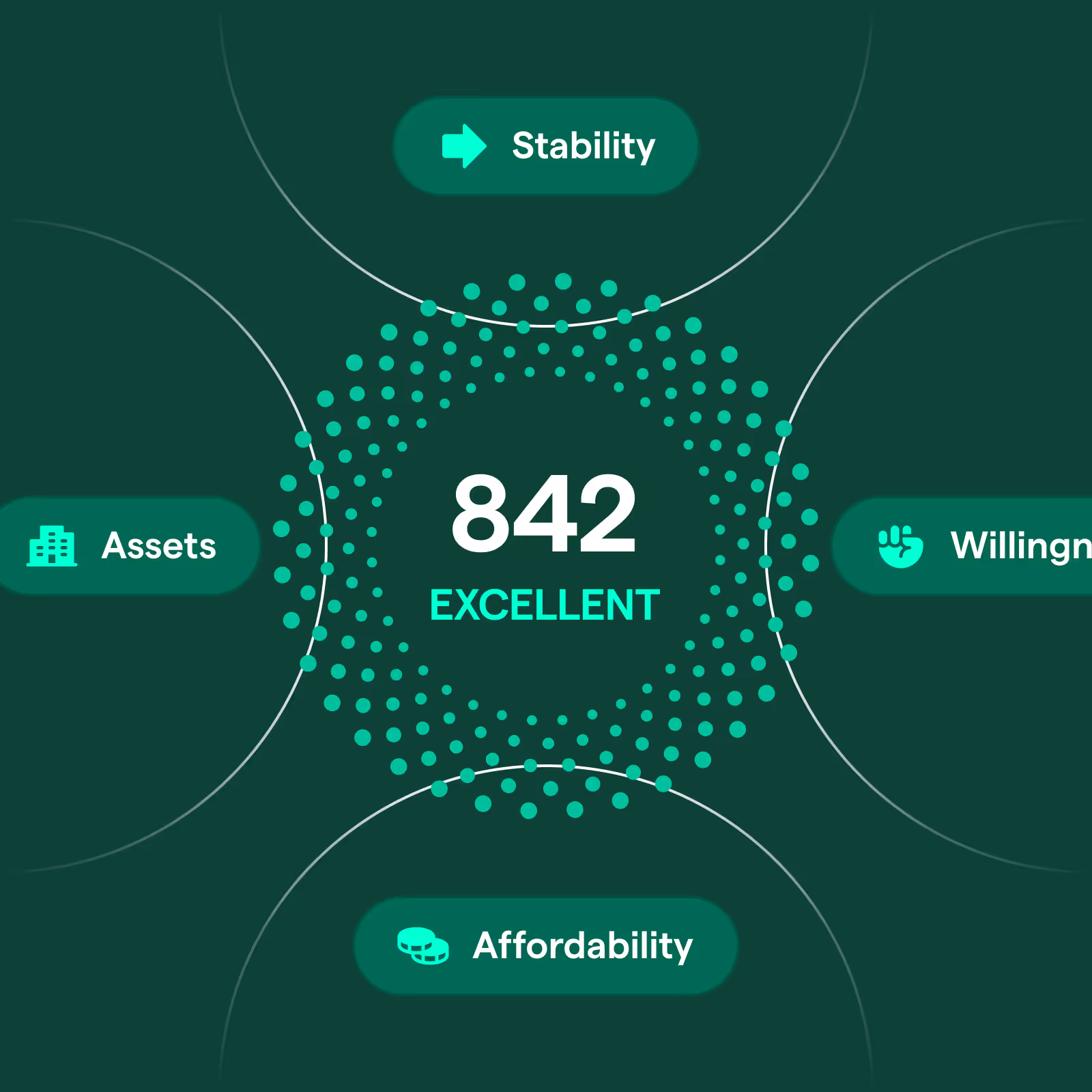

Cashflow Scores

Offer higher amounts and drive growth with our Cashflow Scores, built on Cashflow Attributes and repayment history. Increase approvals and retention by identifying healthy, underserved borrowers.

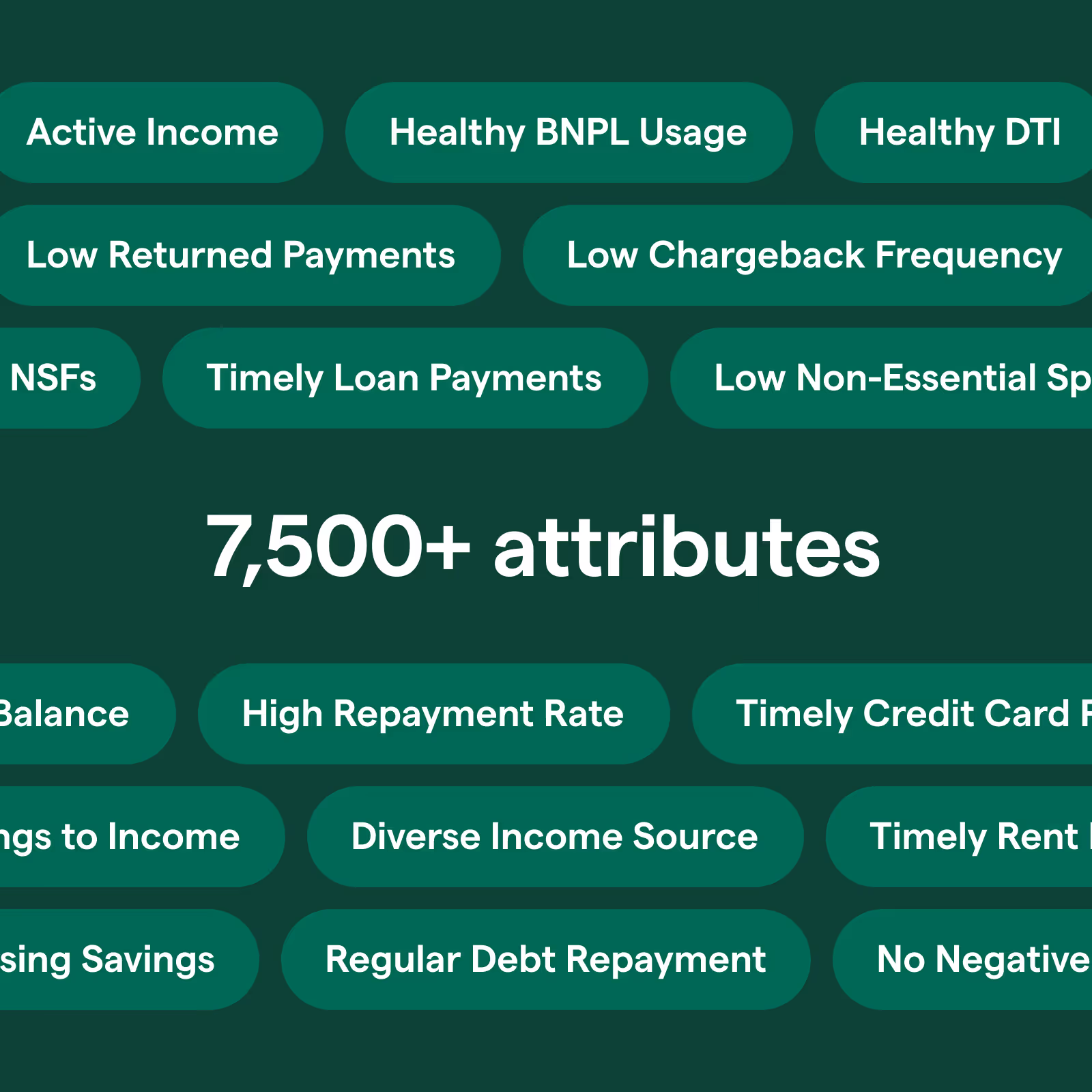

Cashflow Attributes

Drive lift in your risk models to boost approvals with thousands of pre-built attributes built on our expansive loan performance dataset.

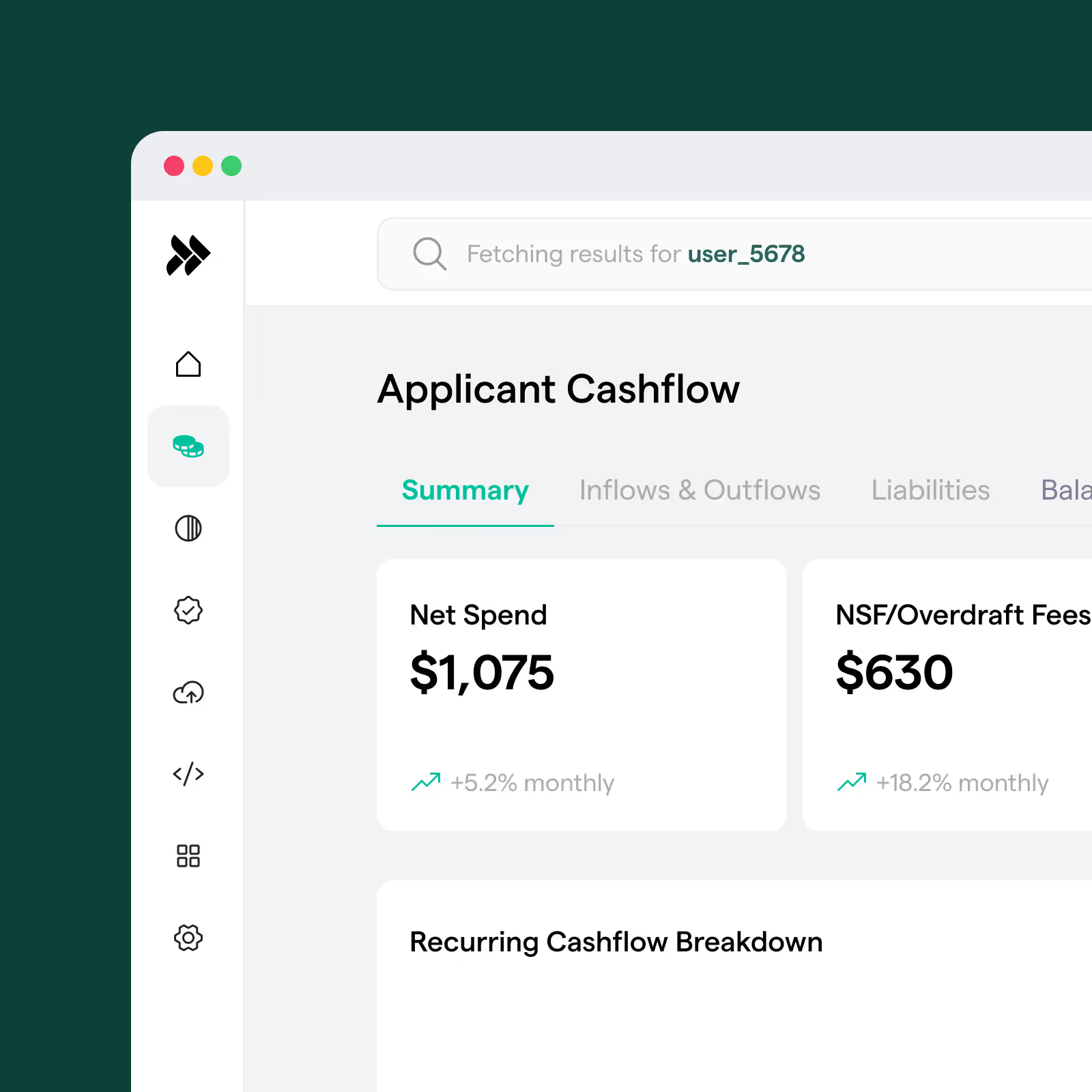

Cashflow Analytics

Automate processes to increase approvals and serve more borrowers using Pave’s real-time Cashflow Analytics. Streamline operations and identify healthy, underserved borrowers.

Cashflow Analytics in Snowflake

Gain seamless access to cashflow data within Snowflake to enhance analysis and decision-making. Leverage Pave’s standardized tables, updated daily, to uncover insights without complex ETL.

Related Posts

Drive growth with Cashflow-driven Analytics

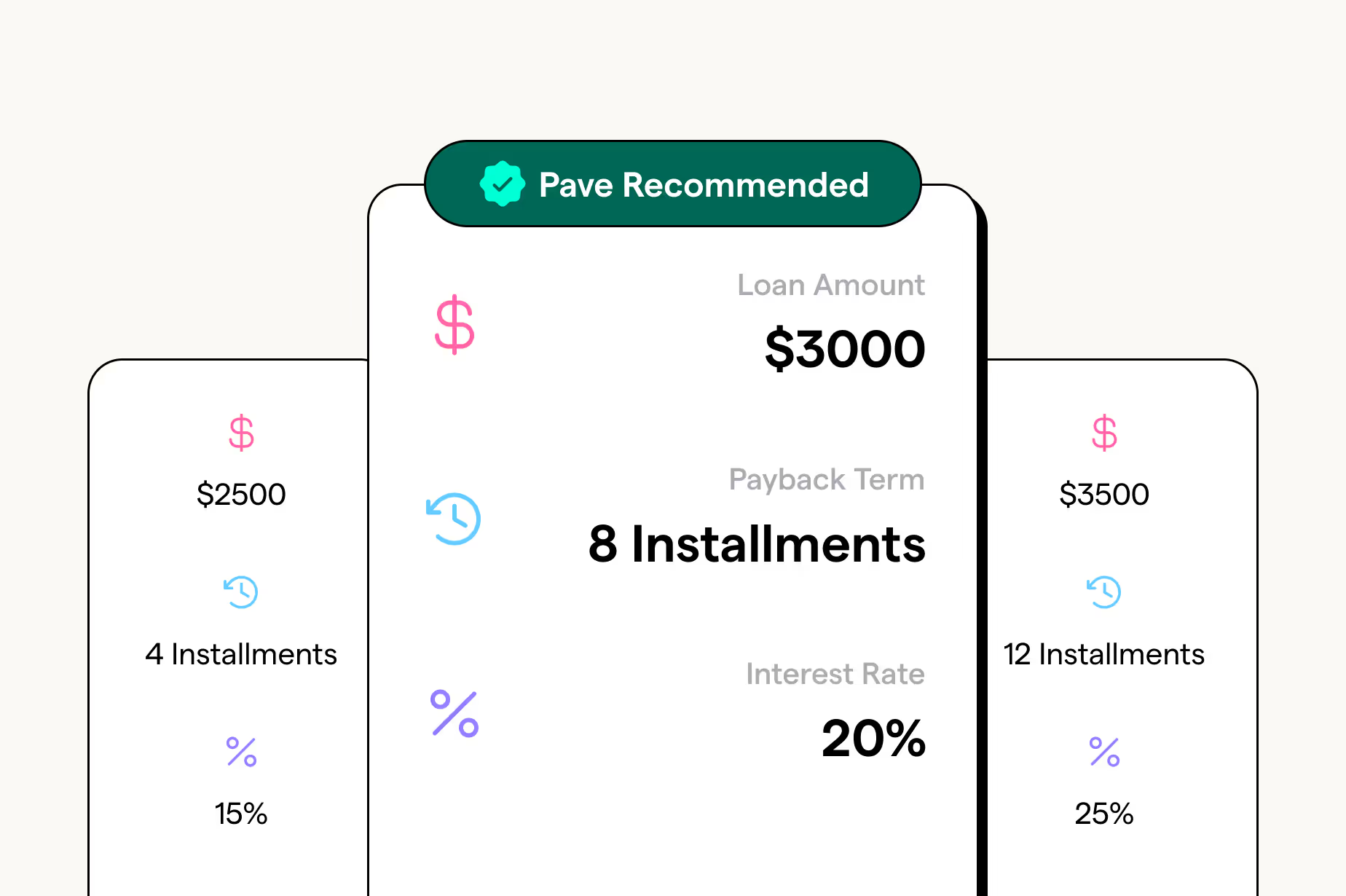

Use our Cashflow-driven Attributes and Scores to provide timely, borrower-specific insights tailored to your lending criteria. Make informed decisions that enhance approval rates and loan performance.

More Use Cases

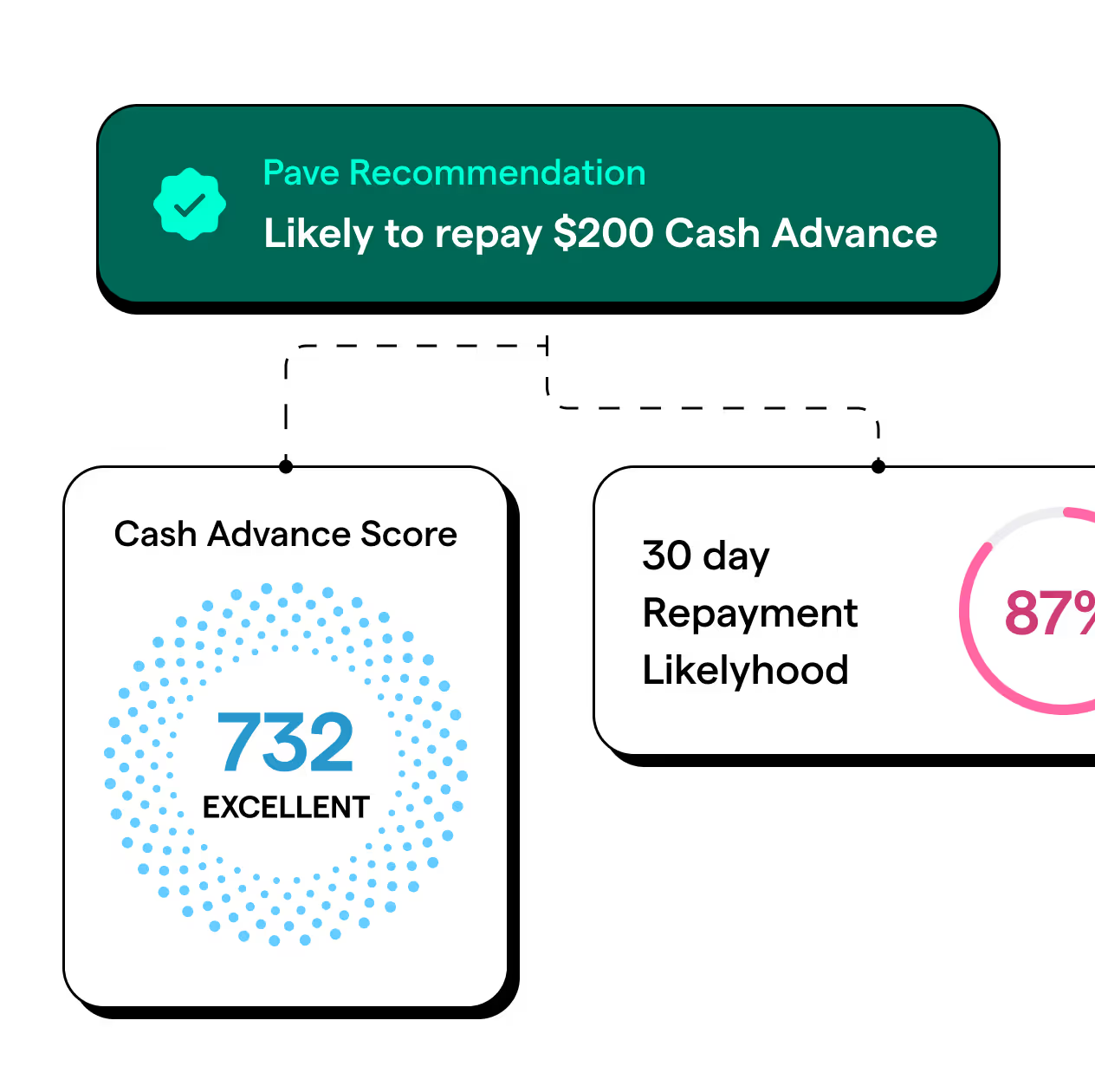

Cash Advance

Score users to increase approvals, advance amounts, and improve repayments.

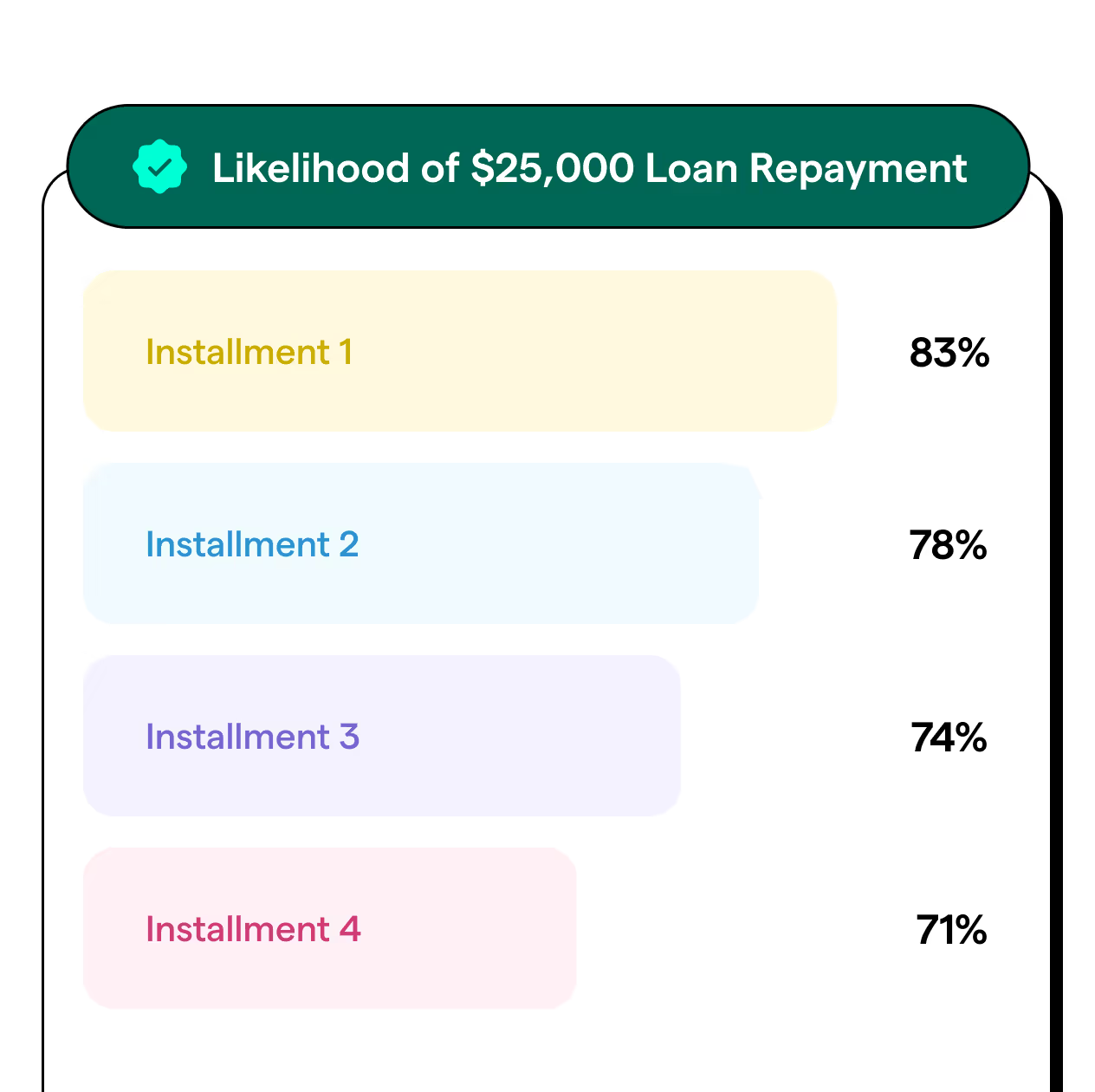

Personal Loans

Identify users with high likelihood of making the first 4 payments to reduce delinquencies.

Small Dollar Loans

Predict repayment likelihood for the first 4 payments to reduce defaults.

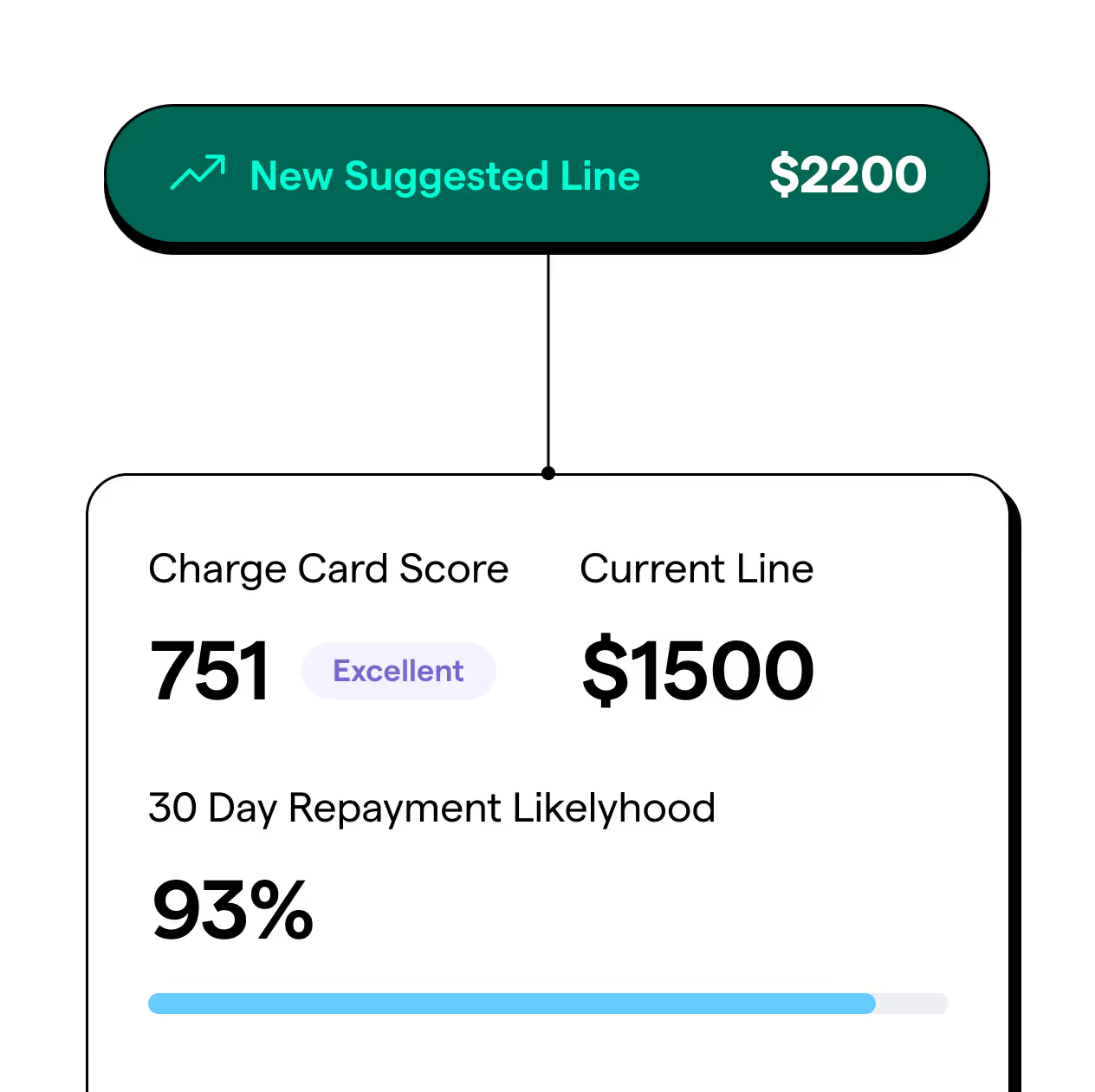

Credit Cards

Set dynamic credit limits based on users' income and affordability.

.avif)