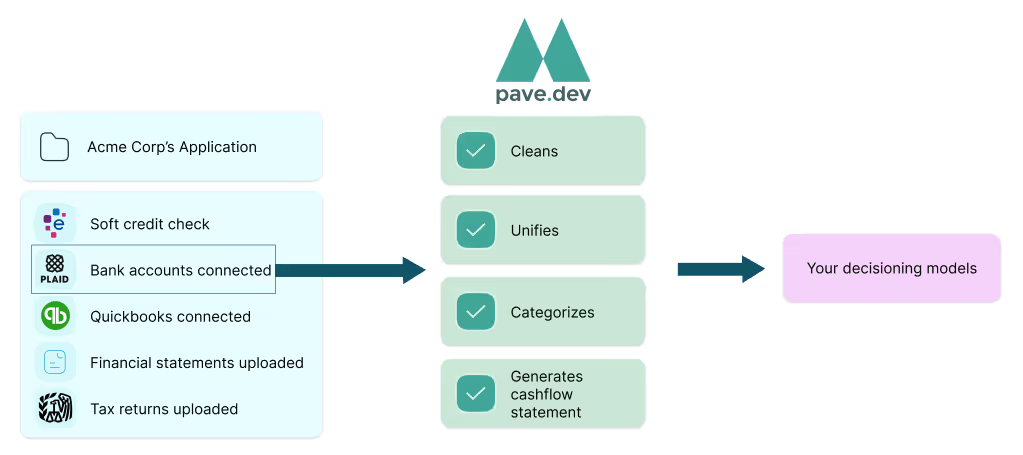

We’re excited to introduce our new Automated SMB Cashflow Statement, available through our Dashboard or API for real-time credit decisioning.

Why it matters

Today, SMB lenders rely on often outdated and error-prone data (accounting data, financial statements, and tax data) to assess credit risk.

Pave analyzes bank transactions for a real-time and highly accurate view of the SMB’s cashflows.

Use Cases

- Automate underwriting: Improve credit risk decisions with up-to-date cashflow data.

- Validate cashflows: Confirm the accuracy of business inflows and outflows.

- Assign credit limits: Set credit limits based on real-time financial health.

Key Benefits

Bank transaction data is a source of truth – the most real-time and reliable source of information to assess the health of a business.

Enhanced Credit Assessment

Gain up-to-date insights into financial health for more accurate evaluations.

Real-Time Monitoring

Proactively manage risks with continuous tracking.

Operational Efficiency

Automate processes to reduce manual effort and costs.

For a detailed overview, watch our video here: https://www.loom.com/share/729816eff1c54ef79081b0c1f513582d?sid=6c33815d-2fbc-4596-a178-fdd1718dc6f5

How it works

- Transaction Mapping: Each transaction is mapped to a master category.

- Categorization: These include Revenue, Operating Expense, Investing Activity, Financing Activity, and Transfers.

- Detailed Breakdown: Each master category is further divided into detailed categories. For example, Operating Expenses includes Payroll, Rent, Entertainment, Utilities, etc.

- Integration: Easily integrate these insights into your credit decisioning workflows via API or CSV download.

Our analytics cover both businesses and personal guarantors, depending on your use case. Plus, you can embed these analytics into your own workflows.

Let us know if you’d like access at api@pave.dev!